Things to Think About When Caring for an Elderly Parent

December 19, 2019

“Caregiving often calls us to lean into love we didn't know possible.”-Tia Walker

It is essential to bring up a parent’s aging expectations and set goals together even though initial discussions may be uncomfortable. Often, an exploration into a parent’s future thoughts about health, finances, and residential plans can make the difference between reacting to a crisis or following an established plan that can bring both the parent and their children peace of mind. The sooner an identified caregiver begins a dialogue, the better the outcome for all involved.

It is common for an older parent to try and shield loved ones from some of their harsh realities – whether financial or health-related – because they are reluctant to accept help, embarrassed by their finances and don’t want to be a burden, or are hiding some critical health information. Even in the best of health circumstances an older parent’s ability to remain independent and manage their life can be challenging. Family caregivers are essential to the experience of aging in America and while individual care needs vary there are some general topics to address when helping an aging parent.

Safety issues are paramount. If there are assets and retirement plans in place, do not allow an aging parent to become financially vulnerable. In the most recent report released by the Department of Justice (DOJ) more than 2 million elderly Americans were defrauded out of more than 750 million dollars in one year. Get educated and learn systems that can protect parental assets. Physical safety must also be addressed to prevent accidental falls in the home. Technology can be adapted into the home to have environment lighting controls and other comforts that can keep a parent safer. Driving is also a topic that needs to be discussed. At what point is it best to remove a parent from behind the wheel to avoid unintended accidents that can be costly both financially and health-wise.

Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (IADLs) are the basic foundation of day to day functioning. IADLs include chores such as managing finances, transportation, home maintenance, shopping, and meal preparation. ADLs include eating, bathing, getting dressed, toileting, transferring and continence. The level of need in the described activities generally determines the sorts of care and housing arrangements a parent, caregiver, and family must consider.

Health and medical issues are pervasive as a parent ages. Many elder parents suffer from chronic conditions requiring medications, management, and monitoring. A caregiver may notice new health concerns that will need attention and routine visits to physicians to diagnose any new medical conditions. Dementia and other serious chronic illnesses can cause a parent to lose their ability to manage their health decisions or oversee their medical care. A medical power of attorney becomes necessary in the event a parent is no longer able to make sound decisions. All of these legal and financial issues that address health directives must be documented with the necessary legal paperwork. Legal designations such as a will, trust, and power of attorney are also essential to have in place. When the time becomes necessary, this documentation affords a designated power of attorney, and medical power of attorney the right to act on a parent’s behalf without the time-consuming need to address the courts for permission. Very often a caregiver is assigned these legal designations. Planning for a parent’s inevitable future decline, emergencies, and end of life care goes a long way to helping reduce stress, hassles and sometimes expense.

Housing issues are at the forefront of successful aging. Is a parent able to age in place, particularly with the aid of technologies that simplify their day to day living? If they are not, what sort of environment is best suited to their current needs? Do they need to move in with a family member or might they require assisted living? If so, is that financially viable? How does housing address the parent’s quality of life? Beyond the basic needs, a caregiver and family should want a parent to thrive, not just survive. It is essential to learn what matters most to the parent and what they would be willing to compromise on if the need arises. A parent’s desire for social connections, autonomy, dignity, and purpose must be considered to ensure a positive quality of life.

Finally, the management of family dynamics and relationships often brings many challenges and painful emotions to process. A caregiver deals with relationship stresses that can include physical exhaustion, financial depletion, and emotional burnout. A caregiver is only as useful to a parent as they are to themselves. While setting boundaries can be difficult, establishing frameworks that designate acceptable norms are healthy for all involved. A caregiver who puts their well being in jeopardy will also affect their ability to care for a parent. Some strategies for wellness in a caregiver’s life include: joining a support group, asking family members for help, learning to say no when needs outside established boundaries arise, and allotting time for themselves.

There is much to consider. Planning can become complicated as our emotions and relationships are involved when setting forth caregiving expectations and parent aging plans. Elder law attorneys help families navigate the aging process and plan for how to find and access appropriate care. Contact one today (preferably one that is Board Certified in Elder Law) and schedule an appointment to discuss how you can begin proper planning.

What is an Irrevocable Trust? An irrevocable Trust in Florida is a trust agreement that by its terms cannot be revoked or amended. The important part for the maker (settlor) of the Trust to understand is basically, once the trust is made and finished, it cannot be changed. You may not amend or change anything in your trust once it is completed and notarized. Your beneficiaries or successor Trustee(s) may only change an irrevocable trust in unusual circumstances. Typically, irrevocable trusts are created for tax purposes, however irrevocable trusts can also be used in Medicaid situations or with Life Insurance. In Discussing “Irrevocable Trusts” in this section we are referring to trust which are made with the intent of being irrevocable. Trusts may also become irrevocable by statute when a Settlor dies. Irrevocable Trusts are infrequently used and should only be created after very careful consideration and consultation with an attorney.

Doris Duke. Mistake: Bad Choice of Executor Doris Duke, the tobacco heiress who died in 1993, had an estimated estate of $1.3 billion. She inherited most of her money at the age of 12 when her father died. However, she responsibly managed this wealth over the course of her lifetime, increasing the inheritance value. Ms. Duke originally set up her Charitable Trust and Will with her longtime friend and physician as executor. However, months before her death, ill and secluded in her California home with only her butler, and she amended her documents and named her butler as the person to fulfill her wishes. Following her death, the former executor of her estate, her longtime friend and doctor, contested the validity of her decision to change executors, believing that Ms. Duke was not of right mind when she executed the new will, and was a victim of elder abuse by her butler. Contesting a will based on elder abuse is generally done for two reasons: (1) Lack of mental capacity of the testator (person signing) at the time of signing; (2) The person contesting believes that the testator was subject to undue influence at the time of signing. Undue influence is a serious legal contractual defense and is generally defined as a contractual situation in which "one party to the contract is a person with weaknesses which make him likely to be affected by such persuasion, and that the party exercising the persuasion is someone in a special relationship with the victim that makes the victim especially susceptible to such persuasion;"[1][1] Many states have their own specific definitions within their statutes. After three years of legal battles, utilizing 40 lawyers, and using $10 million dollars in legal expenses Doris's butler eventually agreed to take a payout in exchange for renouncing his seat on the Doris Duke Charitable Foundation board, and stepping down as executor. Ms. Duke's situation is a two-fold lesson. The planner must be diligent in their estate planning and be aware of the risk of financial elder abuse as they age. Family members or close friends are often named as Personal Representative or Successor Trustee of estates, but if you are unconfident in their abilities, banks, credit unions, and even estate planning attorneys are able to serve in these capacities. Don’t make the mistakes that Doris Duke made when she changed her estate plan. Consult a local attorney to set up a Trust and to make sure that any amendments (changes) you make are in your best interest.

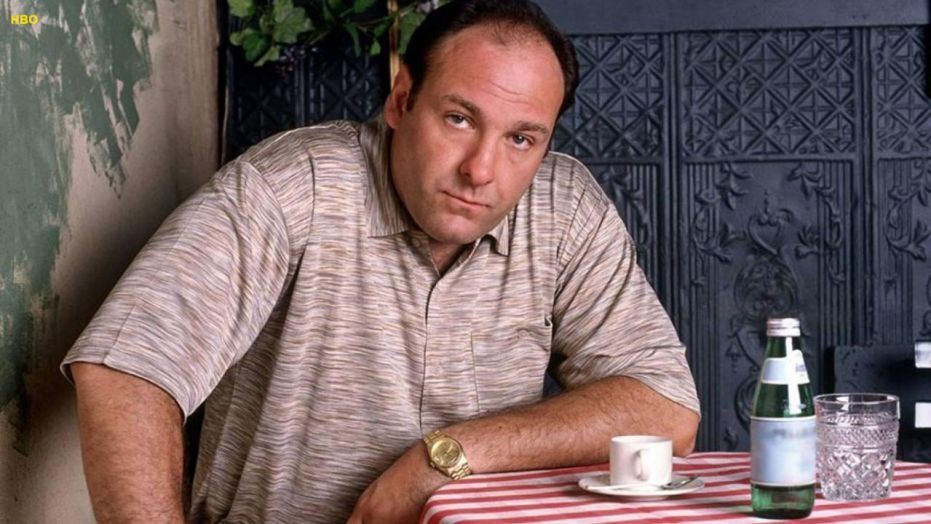

James Gandolfini. Mistake: Not setting up a Marital Trust and Probate “If someone owes you money, even if you gotta crawl, you get it” –Paulie Walnuts Most people remember the iconic show “The Sopranos” where James Gandolfini played the Mob Boss, Tony Soprano. At the show’s conclusion, Mr. Gandolfini appeared in good health, but at the age of 51 he suffered a heart attack, resulting in his death. When Mr. Gandolfini planned for the end of his life, he attempted to plan so that his assets would go to specific decedents. He decided to divide his estate between multiple beneficiaries through the use of a will; these included friends, two sisters, his son, daughter, and his most recent wife. What Mr. Gandolfini didn’t do while planning, was take proper steps to ensure that the IRS would not be the main beneficiary to his assets. He also didn’t protect his estate from probate. By not setting up a marital trust, he missed his opportunity to establish an unlimited estate tax deduction for gifts to be made to a surviving spouse. Gandolfini left 20% of his estate to his surviving spouse and without the marital trust, the IRS collected close to $30 million of his $70 million estate. Additionally, his estate had to be probated, removing more money from his pool of assets. In family situations where a parent remarries and there is the creation of a step-child/step-parent relationship, the biological parent may be reluctant to leave all of their estate to their new spouse. In cases involving children of previous marriages the use of a marital trust can usually take the advantage of the marital deduction while still ensuring that children will eventually receive most of the estate. A marital trust is a unique estate planning tool that allows the grantor to provide for both their spouse, while also ensuring that their children receive an inheritance. The underlying value to this type of trust is that you are protecting your assets from the claims or a subsequent spouse (should your living spouse remarry). Don’t make the mistakes that James Gandolfini made when he created his Estate Plan. Consult an attorney to set up a Trust and to make sure that your Trust is the right fit for your and your family’s needs.

Trusts and wills are two very necessary parts of Florida estate planning. Trusts and wills may look very similar, they both guard your assets at different different times. A last will and testament goes into effect after the death of the testator. A living trust goes into effect as soon as it’s signed. You can change your will or your revocable living trust right up until the time of your death as long as you remain mentally competent. A grantor who forms a revocable living trust typically names a successor trustee to take over management of the trust after his death. A will can only cover the disposition of property possessed in your sole name at the time of your death, including interests you might have in property such as a tenancy in common. It CANNOT address assets that pass directly to a beneficiary by contract or by operation of law such as life insurance policies or joint tenants with rights of survivorship. A living trust can govern and distribute any property it’s been funded with. The grantor transfers his assets into it after it’s formed. These can include life insurance policies as long as the trust and not the grantor owns the policy, as well as tenancy in common interest. Property passing under the terms of a last will and testament requires probate to legally transfer to living beneficiaries. This includes property that’s directed to a testamentary trust because the probate process essentially forms this trust. Wills become a matter of public record when they’re submitted to the court for probate. The terms of a living trust remain private. Property passing under the terms of both revocable and irrevocable living trusts avoids probate. The trust’s terms are the mechanism by which its assets can move into a new, living individual’s ownership. A trust can continue to hold property for the benefit of certain beneficiaries after the grantor’s death, such as minor children who cannot legally take ownership of their own property until they reach the age of majority or spendthrifts who might otherwise whip through their inheritances. The successor trustee would simply keep the trust up and operating and distribute money or property to beneficiaries under the terms you set when you created the trust. A will does nothing to plan for mental disability because it doesn’t go into effect until the testator dies. Her loved ones would have to approach the court to ask that a conservator or guardian be appointed to handle her affairs if she were to become mentally incapacitated before that time. This can be both costly and stressful. Provisions for disability can be written into a revocable living trust. The successor trustee the grantor has named to take over at his death—someone of his choosing, not the court’s—will also take over if he becomes incapacitated and unable to manage his own affairs.

What is an Irrevocable Trust? An irrevocable Trust in Florida is a trust agreement that by its terms cannot be revoked or amended. The important part for the maker (settlor) of the Trust to understand is basically, once the trust is made and finished, it cannot be changed. You may not amend or change anything in your trust once it is completed and notarized. Your beneficiaries or successor Trustee(s) may only change an irrevocable trust in unusual circumstances. Typically, irrevocable trusts are created for tax purposes, however irrevocable trusts can also be used in Medicaid situations or with Life Insurance. In Discussing “Irrevocable Trusts” in this section we are referring to trust which are made with the intent of being irrevocable. Trusts may also become irrevocable by statute when a Settlor dies. Irrevocable Trusts are infrequently used and should only be created after very careful consideration and consultation with an attorney.

Powers of attorney can bring peace of mind to both elders and their caretakers. Powers of attorney allow elders to empower a trusted person to make decisions about health care and finances on their behalf. Having such powers in place when a loved one loses the ability to make sound financial decisions can be priceless, especially if the person in need of help denies or is not aware of worsening physical or mental health. Here is your guide on how to get a power of attorney for elderly parents. What Documents Will You Need? If the person you’re caring for is still of sound mind (a little forgetful is okay, as long as they can understand the plans you suggest) and receptive to the idea of setting out medical wishes and naming someone to handle financial matters, that will make things much easier. You can help the person prepare and finalize both medical and financial powers of attorney. These documents will name someone perhaps you to oversee medical care and handle financial matters. Here’s a brief overview of both documents. Medical power of attorney. This document often called a “durable power of attorney for health care” names a trusted person to make healthcare decisions for someone who can no longer do so, or simply does not wish to. Depending on the person’s state of residence, the health care representative may be called an agent, attorney-in-fact, health care proxy, health care surrogate, or something similar. The health care agent X works with doctors and other health care providers to make sure the person who makes the document gets the kind of care they wish to receive. When arranging care, the agent is legally bound to follow the document maker’s treatment preferences to the extent that he or she knows what they are. To make health care wishes clear, the person you’re caring for can use a second type of health care document often called a living will or a health care declaration to provide written health care instructions to the agent and health care providers. To make it simple, some states combine a durable power of attorney for health care and living will into a single form, commonly called an advance health care directive. Financial power of attorney. The financial power of attorney you’ll want to help your loved one prepare is called a “durable power of attorney for finances.” This document will let your family member or friend give someone else full authority to handle financial matters. The appointed person is usually called the “agent” or “attorney-in-fact,” though he or she most definitely doesn’t have to be an attorney. The agent can handle mundane tasks such as sorting through mail and depositing Social Security checks, as well as more complex jobs like watching over retirement accounts and other investments, or filing tax returns. The agent doesn’t have to be a financial expert, just someone who is completely trustworthy and has a good dose of common sense. If necessary, the agent can hire professionals to help out with complicated tasks. If Your Loved One Resists Your Help If you think someone who needs help will resist your efforts, you need to carefully consider the way you approach the subject. This is what you need to know about how to get a power of attorney for elderly parents who are resistant to your help Explain why powers of attorney are important. For some stubborn folks, it may be enough to explain why planning is important. Some people may be moved by a request to make powers of attorney because it will relieve anxiety and pressure for you and others who care about them, even if they don’t much care what happens or who makes decisions for them. Others may be more inclined to make health care and financial documents if they understand that doing so is the best way for them to stay in control of their lives because whomever they name must follow their instructions in every way possible. (If they don’t name their own representatives in powers of attorney, a court may appoint someone to act without their input.) Of course, when you talk with anyone who’s struggling with increasing frailty, you will have to tread gently around issues of deteriorating mental or physical abilities, perhaps underscoring that planning is a good thing for everybody to do, in case help is necessary someday. Don’t force it. All that said, it’s just as important to remember that legally you can’t and of course, you shouldn’t force someone to follow a certain course just because you think it’s best. If you strong-arm or coerce someone into making powers of attorney and the documents are later challenged in court, you could find yourself in a lot of legal trouble. The same goes for faking signatures on any legal documents. Don’t do it. If your loved one doesn’t want to cooperate and you eventually have to ask a court for control over his or her affairs, that may be difficult, but it’s much better than being charged with fraud or forgery. If It’s Too Late to Plan If a family member is already incapacitated, you’ll need to ask a court to name a guardian or conservator to watch over his or her affairs. A court will usually name a spouse or other very close family member to this position, taking into account any evidence of what the incapacitated person would have wanted and other information about what’s in his or her best interest.

Estate planning is the process of planning for how your assets and estate will be distributed after your death or if you become incapacitated. Through estate planning, you can be certain that your assets will be protected, distributed to the correct people, and be subject to the minimum amount of taxes and costs on your estate. Even if you do not have a Ten-Million dollar estate, you should still contact a financial advisor or attorney to get a start on planning for your estate. Estate planning is something that you should get a head start on when you are younger. Most people think that this is something that you can wait on, but the sooner you start planning, the better your assets will be protected. Estate planning is the series of preparing tasks that decide how your assets will be seperated and distributed once you pass or away or if you become incapacitated. Everything you own is apart of your estate, whether it's your car or your house or stocks or even your life insurance. Even things like joint accounts count as part of you estate too. Estate planning entails far more than just creating a will. It may also include: Assigning a power of attorney and healthcare proxy to make decisions on your behalf Creating trusts Establishing guardians for living dependents Appointing or updating beneficiaries on life insurance plans and retirement accounts Making funeral arrangement Preparing for estate taxes, potentially by scheduling annual gifting Whats you start your estate plan, make a list of all your assets, find the value of those assets, and then decided who you want to leave said assets to. After you have done that, you can begin the process of drawing up your trust. Draw up your last will and testament. In it, you should name an executor, assign a legal guardian for any minor children and establish any necessary trusts. Your will doesn’t account for everything. Now, you’ll need to review all your plans, accounts and shared assets to assign or update beneficiaries. Assign a power of attorney and healthcare proxy to make financial and medical decisions on your behalf if you cannot. Write a letter that includes any information that hasn’t been accounted for. This may include desired funeral arrangements or the bequest of sentimentally valuable assets. Ensure that all documents are organized, properly notarized and stored someplace safe, like your attorney’s office or Safety Deposit Box. This includes a list of your digital assets and passwords. Both a will and a Living Trust are estate planning documents that provide instructions on how your assets are to be distributed to your heirs. While both can achieve similar objectives, a trust gives you capabilities that a will does not. However, those extra options come at a higher price and often require greater effort to establish. You must also transfer assets into a trust for it to be beneficial, as a trust can only control assets that it contains. One of the biggest benefits of a Revocable Living Trust over a will is that a trust allows you to avoid probate. For a will to be enforced, it must go through probate, which can be costly and makes your personal affairs a matter of public record. Another major advantage of a living trust as opposed to a will is that a trust makes it possible to plan for the possibility of your own incapacity, in addition to your death. Ultimately, there’s a lot to weigh when considering the pros and cons of a will vs. a living trust. You can always opt for both, so a will can deal with any property not included in your trust. You should talk to an estate planning professional and do further research before making your decision. Another big piece of the process is estate taxes. If you don’t plan accordingly, taxes can take a big bite out of your estate. Your assets can be taxed in two ways: estate taxes and inheritance taxes. With estate tax, the tax is taken out of the estate before it’s divided up and distributed to beneficiaries. Inheritance tax, on the other hand, is levied after the inheritance is distributed to beneficiaries. While estate tax is taken directly out of the estate, beneficiaries are responsible for paying inheritance tax. Inheritance tax is only levied by states, but both the federal government and states may collect estate tax. As of 2018, the federal estate tax only applies to estates that are worth more than $11.2 million. Twelve states and the District of Columbia levy their own estate taxes, and it often only applies to estates over a certain value. Only six states still impose an inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. There are steps you can take to mitigate estate tax so more of your assets go to your beneficiaries. For instance, you can gift portions of your estate to your family ahead of time instead of waiting until you die to give everything away. Other tactics include setting up an irrevocable life insurance trust making charitable donations, establishing a family limited partnership and funding a qualified personal residence trust. Stanek, Becca. “Estate Planning: What It Is and What You Need to Know.” SmartAsset, SmartAsset, 19 July 2019, smartasset.com/retirement/estate-planning.

What really is probate? Probate is initiated by the estates executor or the attorney incharge of the estate. During the probate process, a probate court validates your will and then authorizes your executor to distribute your estate to your beneficiaries as you wish, as well as pay any taxes that you may owe on the estate. If there is no will, a even lengthier administrative proceeding will be held to determine how your estate will be divided. If this happens, the court will name an administrator for your estate who will follow the probate judge’s instructions on how to distribute your property. Why Should You Avoid Probate? Although probate is often straightforward, many people want to avoid it. The reasons can vary, but there are some common complaints about the process: It can be slow. In some cases, it can take years for a probate court to finalize an estate, especially if it’s complicated or involves a contested will. It can be costly. Costs vary from state to state, but probate generally entails executor fees, attorney costs and other administrative expenses, such as appraiser’s fees. In some cases, these charges can accumulate quickly. The expenses are exacerbated if the process drags on for a while. It is public. Since it is a state legal proceeding, what goes on in probate court does not stay there. All the material in the probate process goes into the public record How Can You Avoid Probate? Regardless of why you want to avoid probate, there are steps you can take to do just that. Have a small estate. Most states set an exemption level for probate, offering at least an expedited process for what is deemed a small estate. In some cases, “small” actually can be quite large. Check your state’s probate estate limits. Give away your assets while you’re alive. You might be able to get your estate to a simplified or exempt probate position by reducing its value while you are still here. Instead of leaving your assets to family and friends after you die, give them the items before then. Not only can this reduce the amount of your estate that goes through probate, it also might help trim or even eliminate future federal and state estate taxes. Establish a living trust. Trusts are appealing when it comes to avoiding probate because property held in trust is not part of your estate upon your death. The reason? A trustee, not you, controls the trust property, and is obligated to distribute it under the terms of the trust agreement. Make accounts payable on death. Bank and other accounts that are payable on death go directly to your designated beneficiary without going through probate. Some states also allow such transfers of real estate. Own property jointly. Making your spouse or someone else a joint owner facilitates the transfer of the asset without the need for probate. Some ways to hold such assets include joint tenancy with right of survivorship, tenancy by the entirety and community property with right of survivorship.

Do you qualify for Florida Medicaid? To qualify for federal funding, state Medicaid programs are required to cover certain populations, such as low-income children and pregnant women. States can also choose to cover optional coverage groups, like low-income adults without dependents. Each state sets its own income limits for qualification, based on minimum levels set by the federal government. Florida has set below-average limits for the mandatory coverage groups, and since the state has not accepted federal funding to expand Medicaid, the eligibility rules have not changed with the implementation of the ACA. Able-bodied, non-elderly adults who don’t have dependents are not eligible for Medicaid in Florida, regardless of how low their income is. Florida’s eligibility standards as of April 2018 are: Children up to 1 year old: 206 percent of the federal poverty level (FPL) Children ages 1-5: 140 percent of FPL Children ages 6-18: 133 percent of FPL Pregnant women: 191 percent of FPL Young adults, ages 19 and 20: 29 percent of FPL Adults with dependent children: 29 percent of FPL People who qualify for Supplemental Security Income (SSI) automatically qualify for Medicaid in Florida. See more information in the SSI-Related Programs Financial Eligibility Standards. How do you sign up for Medicaid? If you’re eligible for Medicaid, you can enroll at Healthcare.gov. You can also apply online at ACCESS Florida, or fill out a paper form. Use this application for low-income children, pregnant women, families, and aged or disabled individuals who are not currently receiving Supplemental Security Income (SSI). Use this application to apply for food or cash assistance in addition to Medicaid. You should also use this form if you currently receive SSI or if you are applying for home-based and community services, hospice care, or nursing home care. Paper applications can be submitted by mail, fax or in person to a local service center. For help with the application process, call 1-866-762-2237. Source: https://www.healthinsurance.org/florida-medicaid/

Home care for the elderly. What exactly is it? Home care for the elderly, or HCE is a program put in place by the florida government to help care for the elderly population in a different manner than traditional nursing homes. The HCE is a program that supports care for Floridians of the age of 60 and older in family type living arrangements within private homes. A basic subsidy averaging $106 per month is given to all program participants. Special subsidies are authorized for some consumers. These subsidies are used for: Incontinence supplies, Medications, Medical Supplies, Wheelchairs, Assistive Devices, Ramps and home accessibility Modifications, Nutritional Supplements, Home health Aide, Home Nursing, and other services to help maintain the individual in their home. The Department is responsible for planning, monitoring, training, and technical assistance for the program. Unit rate contracts are established by Area Agencies on Aging for local administration of the program within each Planning and Service Area. Services include more than 150,000 subsidy checks issued annually. To be considered eligible, individuals must be age 60 or older, have income less than the Institutional Care Program (ICP) standard, meet the ICP asset limitation, be at risk of nursing home placement, and have an approved adult caregiver living with them who is willing and able to provide care or help arrange for care.